You Spend Regularly…

Do You Invest Regularly?

We all have various dreams that we want to realize – owning a Car, a House or going on a Vacation. Besides these, we also need to plan for Children’s Education, their Marriage and our Retirement.

Achieving these dreams may seem like climbing Mt Everest, but it’s possible if you prepare for it – Step by Step

SIP or systematic investment planning is method through which you can invest in mutual funds through small and periodic installments. Though a SIP can be initiated on any day of the month, we suggest you to consider 12th and 25th of every month for setting aside money for investing. This will ensure that you save some money on 12th after paying all your essential bills and the rest on 25th after meeting most of your monthly expenses! What’s more, the plan comes with the flexibility to invest any amount starting with as little as Rs. 1000. Whether you choose to save during the beginning of the month or towards the end, the important part is to remind yourself to save, just the way you keep reminders for other payments.

What is SIP?

Systematic Investment Plan (SIP) is a financial planning tool that helps you to create wealth, by investing small sums of money every month, over a period of time. A Systematic Investment Plan (SIP) is a vehicle offered by mutual funds to help investors invest regularly in a disciplined manner.

Why is SIP a Smart choice?

- Helps in inculcating financial discipline

- Helps you put investments on your priority list

- Average out your cost of investment and hence reduce your risk

Let’s say you invested Rs. 1000 every month and let’s assume the scheme you invested in is available at a unit value of Rs. 20 per unit. Then in month 1, you will be able to obtain 50 units. In month 2, if the unit value goes down to Rs. 10 then you will be able to obtain 100 units.

Hence for Rs. 2000 invested over 2 months, the total value of your investment at the end of 2 months is Rs. 1500. However, if you had invested a straight sum of Rs. 2000 in month 1 when the unit value was Rs. 20 per unit – your net value at the end of month 2 will only be Rs. 1000.

Hence a SIP helps you average out your cost and thereby reduce risk resulting in generating better returns

- Helps in compounding your wealth

Getting rich is simpler than you think, here’s a simple formula that can help:

Start Early + Invest Regularly = Create Wealth

Invest Regularly

Systematic investing has a compounding effect on your investments. In the long term, an investment as low as Rs 1000/- per month can swell up into a huge corpus.

Start Early

Similarly, starting your investments early also has its own advantages. Starting early means that the power of compounding starts acting on your money earlier, thereby potentially generating better returns.

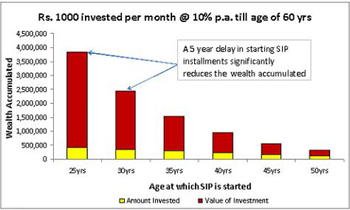

Consider the following graph:

An individual who starts planning for his retirement at 25 yrs of age by investing Rs. 1000 / per month may collect up to Rs. 40 Lakhs on retirement whereas his investment over the period may just be Rs. 4.2 Lakhs

On the other hand, if the same individual delays his retirement planning by 5 yrs, his wealth upon retirement may reduce significantly (approx Rs. 15 Lakhs.)